Verified client financials, straight from the source of truth – the IRS

TaxStatus is the verified financials and IRS Account Monitoring Platform for financial professionals and the clients they serve.

Better data. Better advice. Better outcomes.

Connecting to the IRS is just the start

TaxStatus analyzes over 3,000 datapoints per taxpayer to surface advice opportunities specific to each client for hyper-personalized recommendations. All data delivered digitally without uploads.

Onboard clients & prospects

View personal, trust, & business tax return data

Streamline financial planning

Monitor personal & business IRS accounts

Find forgotten & held-away assets

Identify tax planning opportunities

Optimize outstanding loans

Identify business sales

Official IRS Records

The most complete data from the most accurate source - the IRS

Finally, see what the IRS sees. View and download the most official collection of individual taxpayer and business records available.

- All official income sources

- Retirement & investment accounts

- Mortgage-backed real estate

- Return transcripts from over 45 tax forms and schedules including W2s, 1099s, 1098s, 5498s, K1s, etc

- 10 years of historical and 3 years of future tax records

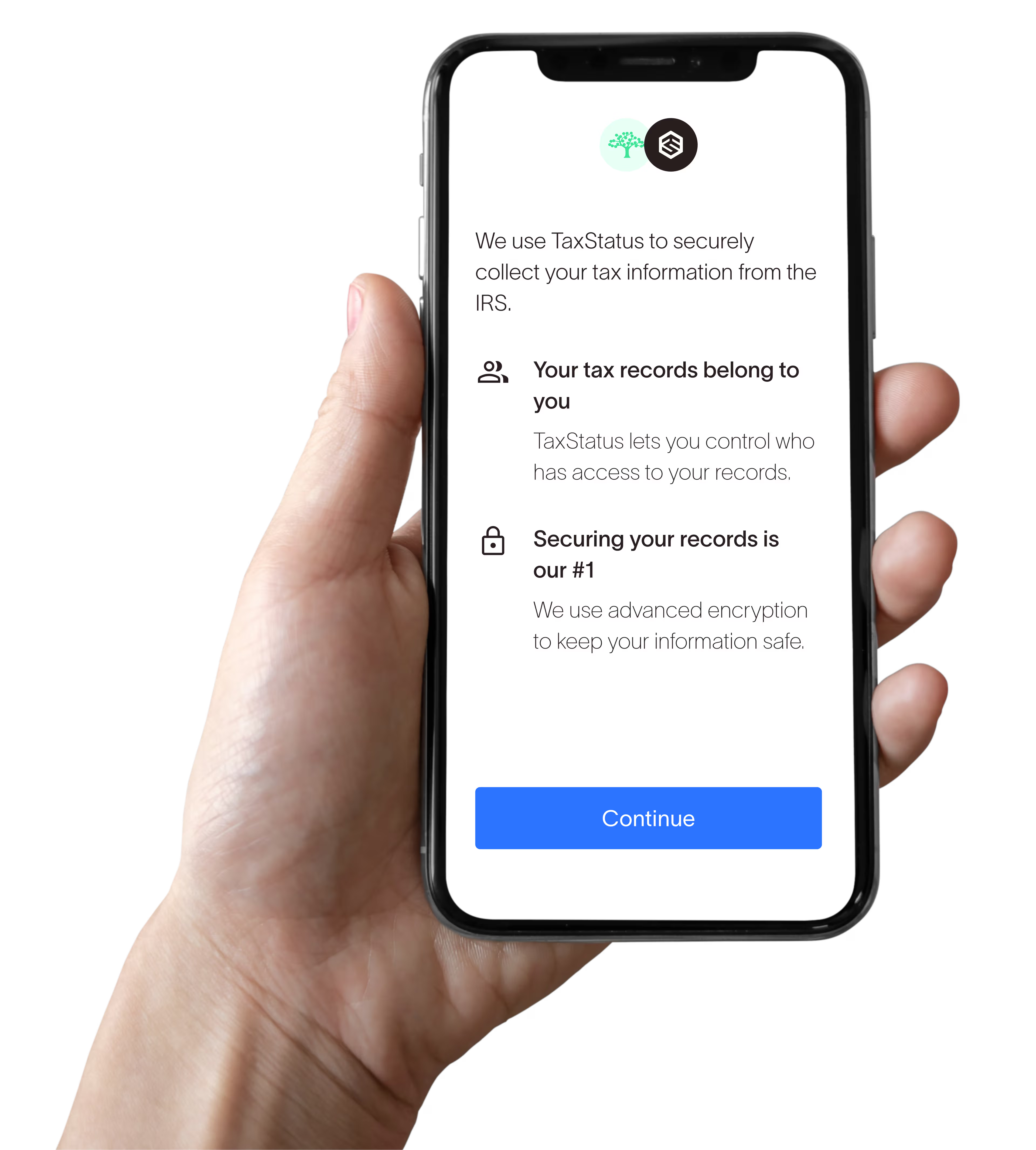

Client Onboarding

Onboard clients and prospects in under a minute

Requesting records has never been easier for you and your clients. Get the data you need fast, without uploading returns.

- Request records effortlessly with a secure consent link through an email or text message

- Embedded KYC / KYB satisfies known customer compliance

- Invite existing clients in bulk for even greater efficiency

- Branded to your firm for added trust and consistency

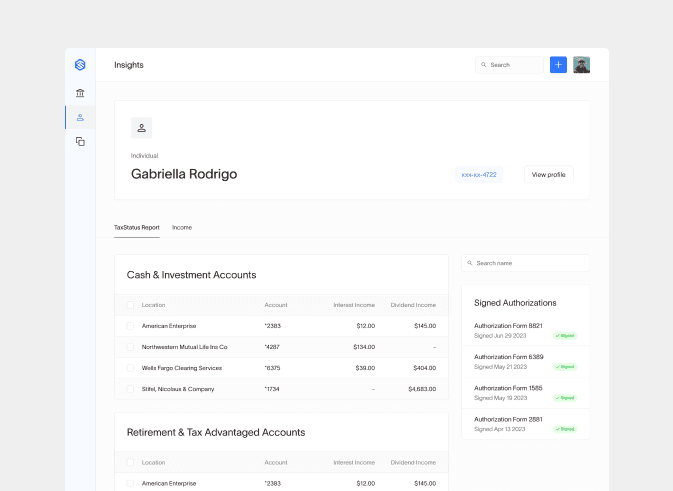

Instant Insights

Save an average of 26 hours per client with TaxStatus

Kick endless data entry to the curb. All of your client information. One convenient dashboard. Zero OCR and no uploads required.

Financial Baseline

Step one in any planning process is now your Financial Baseline

You have access to the most official, accurate, and comprehensive source of client financials. Why start from scratch?

- Identify all income sources to enhance plan accuracy

- Eliminate delays in creating a plan due to missing data

- Pre-populate financial plans (coming soon)

Business Financials

Insights that redefine business as usual

Financial tracking for business owners and investors alike. Manage taxes proactively and keep business booming.

- Revenue history, estimated tax payments, quarterly payroll filings, and annual returns

- Unpaid taxes, penalties, and interest accrued

- Pre-packaged finances for M&A – ready to sell when you are

IRS Account Monitoring

Know before it happens - the good, the bad, and the audit

Real-time IRS notifications keep you in-the-know so you can make smarter decisions – before they become critical.

- Identify unpaid taxes, penalties, and interest

- Identify and get ahead of upcoming audits and collections

- Track quarterly payroll filings and estimated payments

- Know the status of your tax return and if the IRS accepted it

Verify and comply in seconds

Experience the most thorough security protocols in the industry with IRS validation, government ID check, facial identification, and more.

Identity Verification

Scare away fraudsters, not your clients

Ensure your clients and prospects are who they say they are with built-in KYC and KYB.

- Verify anyone and any business in under a minute

- Authenticate government IDs and documents

- Protect your clients from impersonators and scammers

KYC / AML Compliance

Due diligence done without one more to-do

Automatically fight fraud and comply with ever-changing KYC / AML regulations.

- Adverse media and global watchlist screenings

- High profile and politically exposed person and company screenings

- Compliant to United States regulators - IRS, FinCEN, and FINRA

Identity Monitoring

Know your client – today and tomorrow

Automatically keep client identity verification records up to date.

- Identify fraud risk changes with watchlist and adverse media monitoring

- Reverify clients on a recurring schedule

- Always have a valid government ID with expiring ID monitoring

Get up and running in 5 minutes

Client Records in Seconds

Save countless hours of administration with fully digitized access to your clients’ financial records.

Real-Time Updates

Automatic record updates keep you in-the-know so you can make proactive decisions every day.

Security at Its Finest

Enterprise-grade, end-to-end AES-256 encryption and SOC 2 Type II compliance ensure data stays between you and your client.

Premium Support

Responsive assistance when you need it. Drop us a line or explore our Help Center.

For Developers

Powerful and easy-to-use APIs

Integrate TaxStatus into your client experience and the tools you and your team already use. Easily request consent, pre-fill financial and tax plans, keep books and records up to date, and monitor account changes. Read our API Documentation and learn how to get started.