100%

IRS-sourced data

IRS-sourced data

Saved per client

Client onboarding time

More assets uncovered

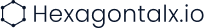

TaxStatus pulls data directly from the IRS — the same data the IRS uses to verify returnsand conduct audits. This isn't client-uploaded estimates. This is the ground truth.

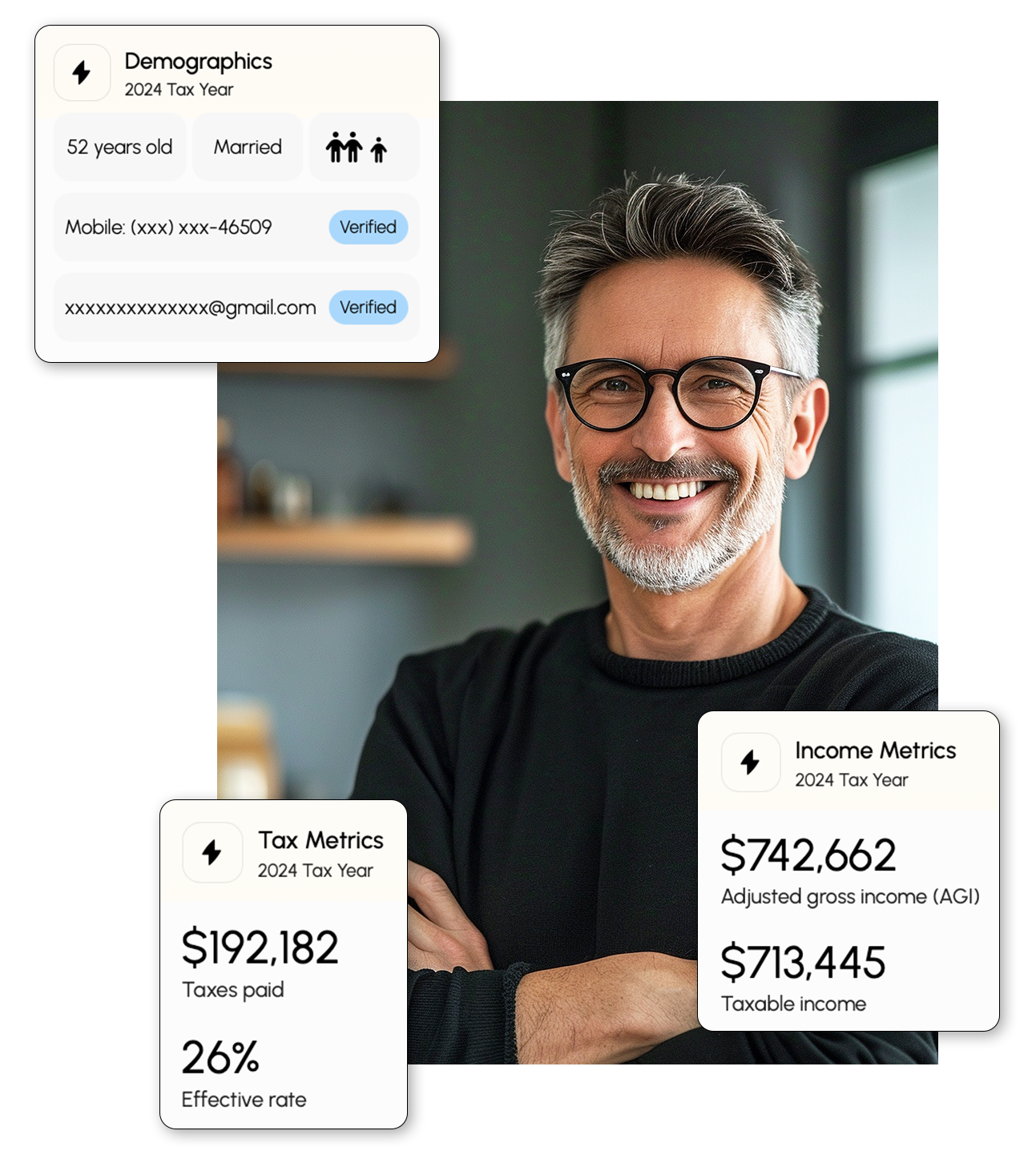

See every financial account — IRA, brokerage, trust, and beyond — organized by custodian, with account numbers and fair market values. Stop guessing what's held elsewhere.

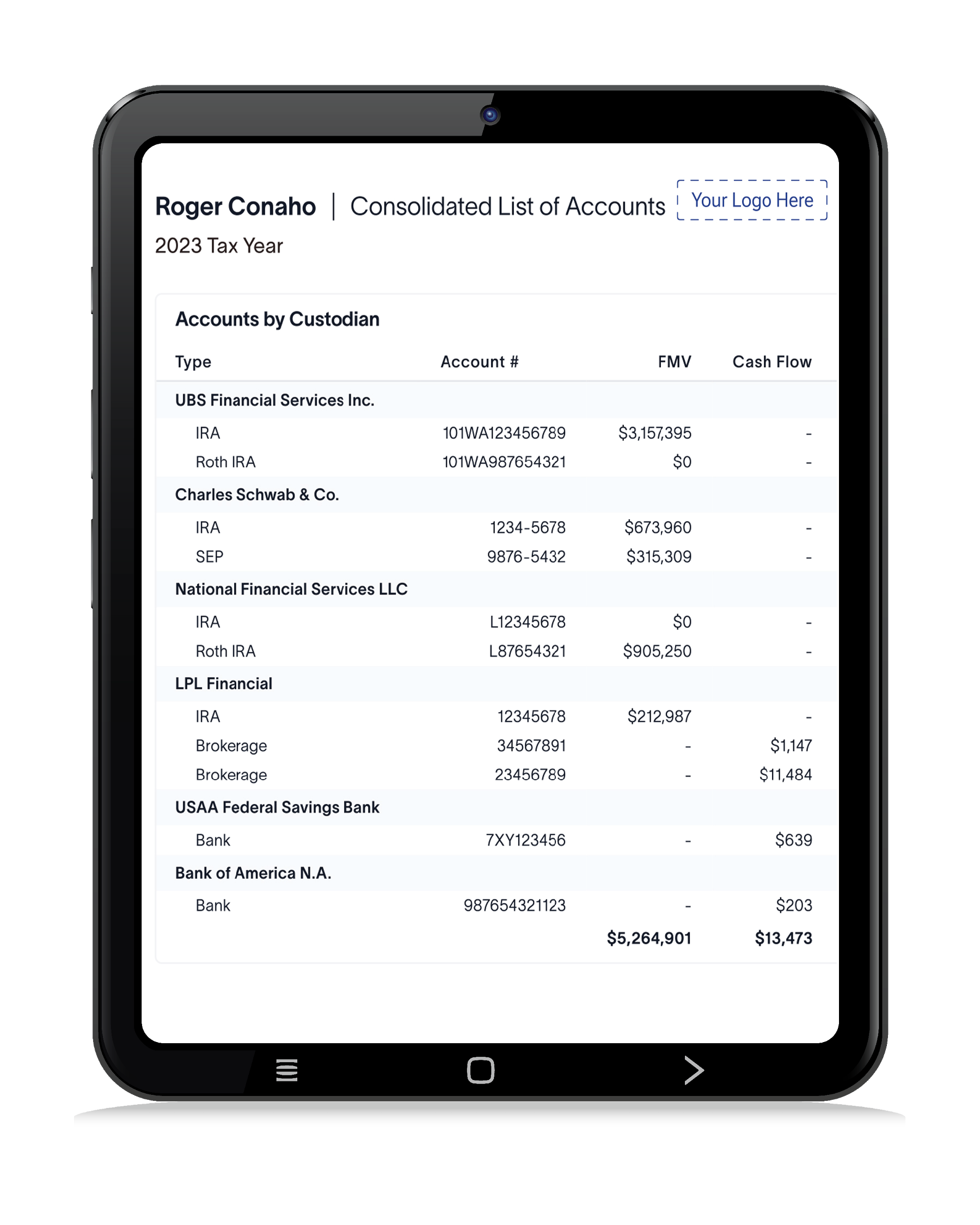

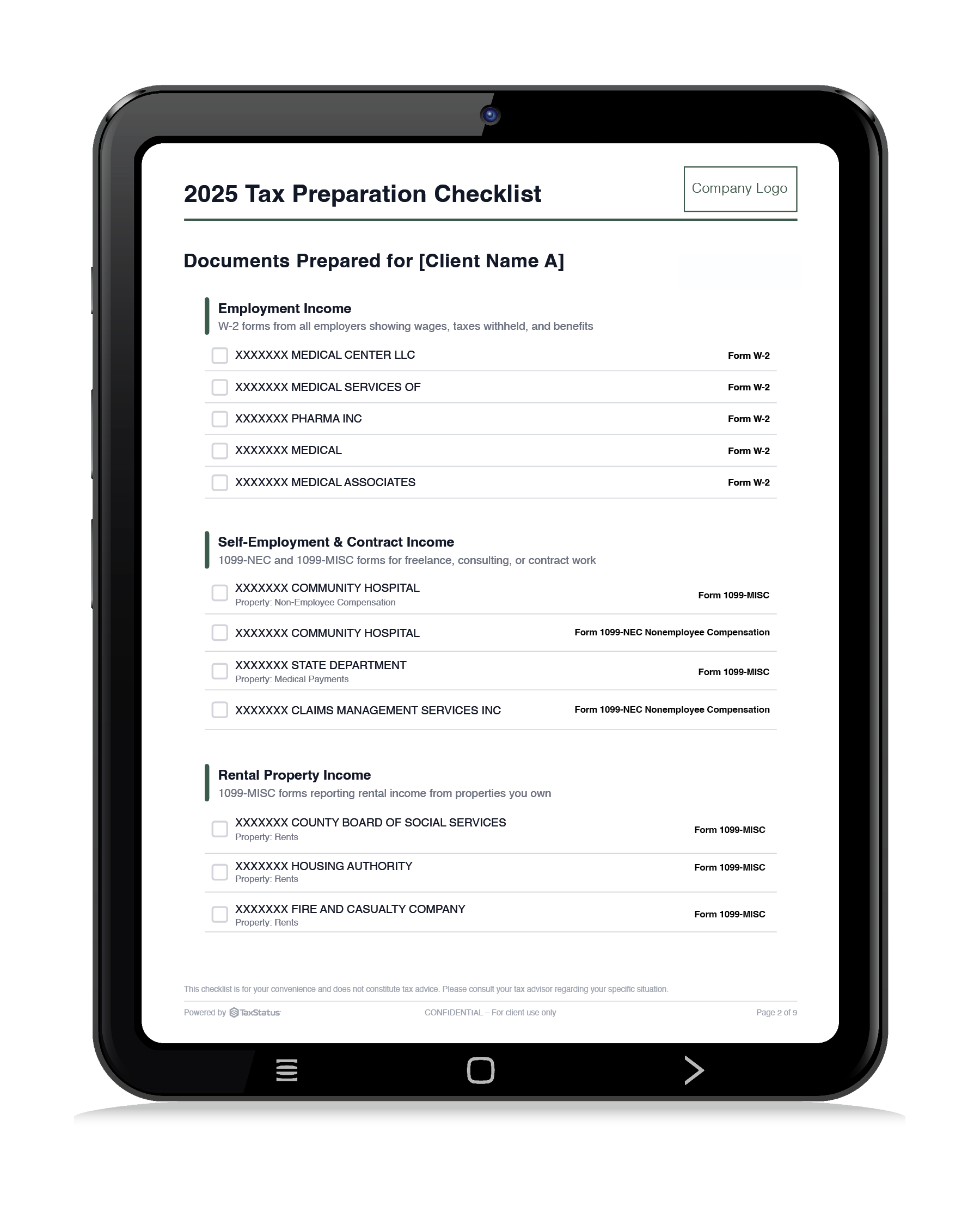

See W-2 wages, 1099 income, Social Security, retirement distributions, rental income, business income — organized, categorized, and ready for planning.

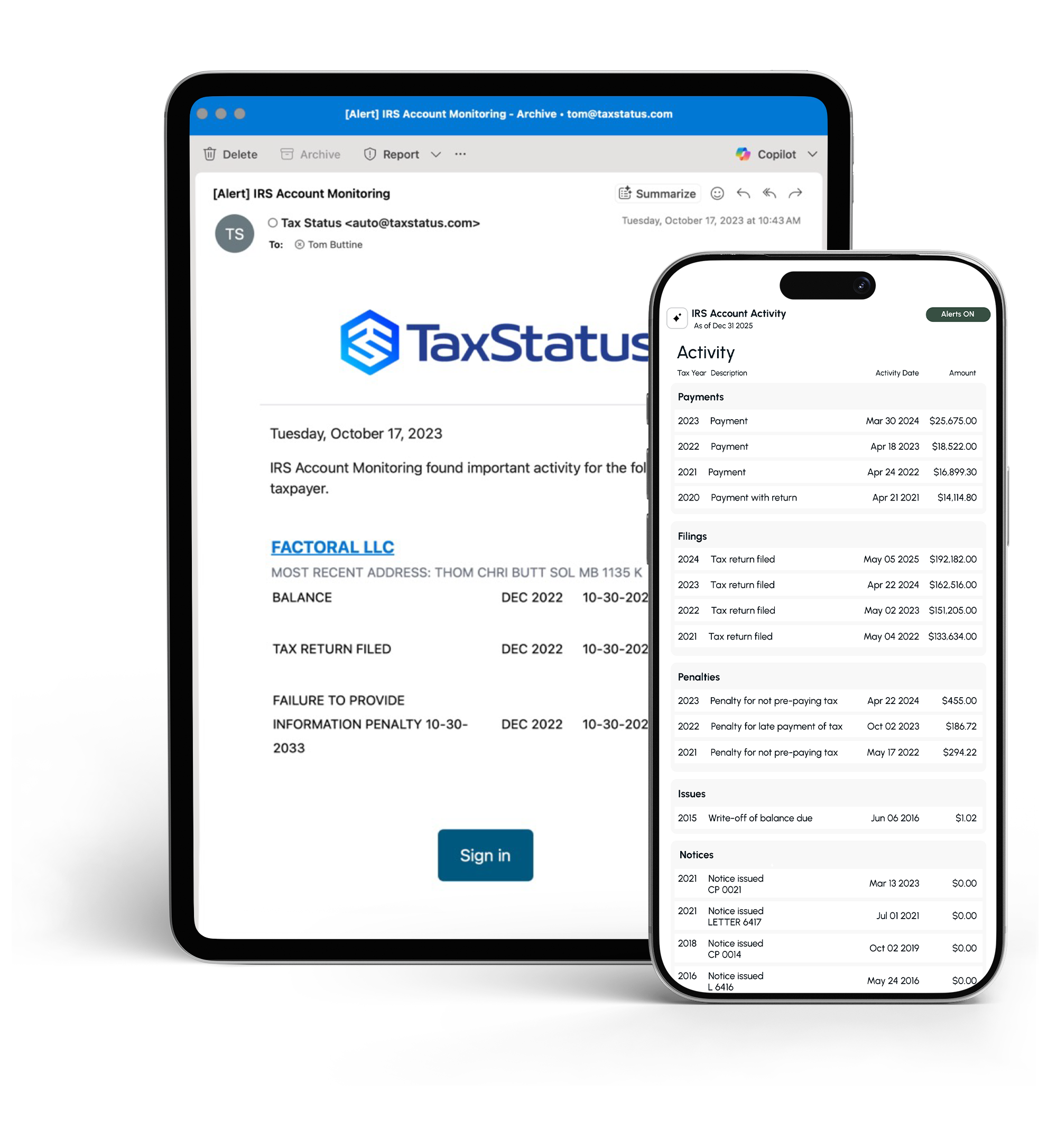

Get notified of audits, collections activity, penalties, fraud attempts, and refunds before your client receives the IRS letter. Monitor your entire client base from one dashboard.

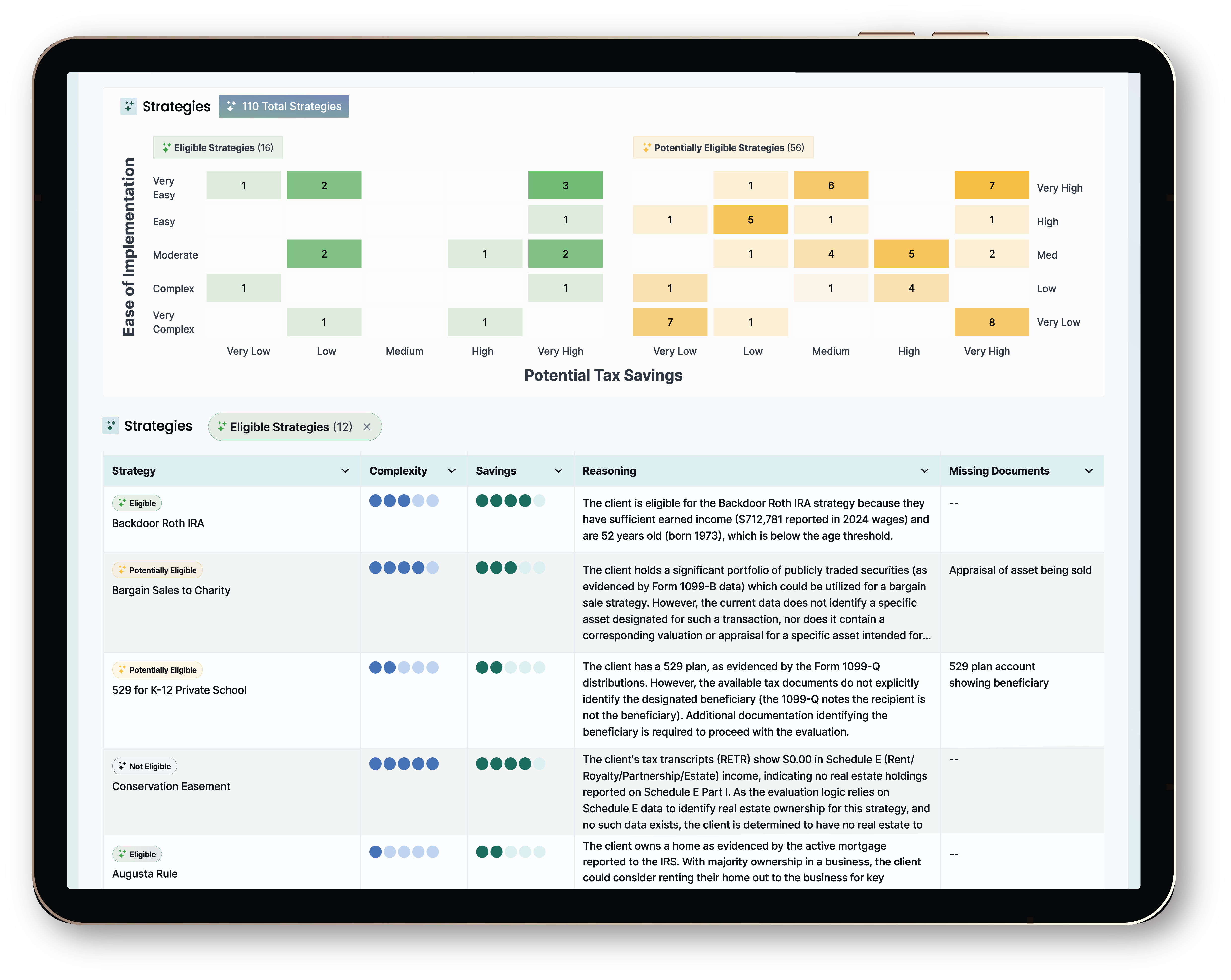

100+ bespoke, multi-strategy tax planning strategies powered by 100% verified IRS data. Each report includes executive summary, compliance risk, implementation steps, and more.

Not a generic template — John's checklist lists all of John's employers, John's accounts, John's forms. Branded with your firm's logo. Sent before tax season even begins.

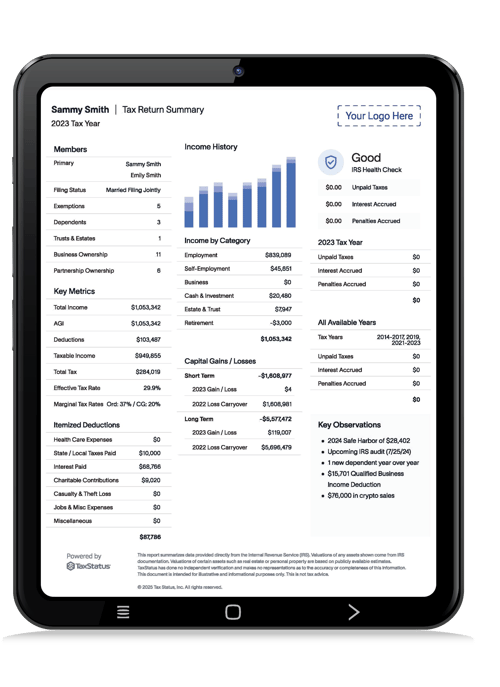

Walk into prospect meetings already knowing their complete financial baseline. Start planning on day one, not after weeks of document collection.

Every account your client owns across, every custodian, in a consolidated view. No more asking "Do you have any other accounts I should know about?"

Run comprehensive tax planning analysis across your entire client base in minutes, not months. Prioritize clients with the highest savings potential.

Excel spreadsheet listing every K-1 received — with associated income, ownership percentage, and entity details. Perfect for pass-through income planning.

Complete employment timeline with all employers, income amounts, and tax withholding — verify job changes and income fluctuations.

Link your own CAF, import your clients, and receive IRS tax transcripts instantly in bulk PDF format.

All assets and liabilities with more than $10 of annual activity — retirement accounts, HSAs, ESAs, trusts, partnerships, and more.

Complete financial snapshot with your firm's logo and branding — perfect for prospect meetings and client reviews.

Secure ID.me verification in under 60 seconds — clients consent and verify their identity without scanning or uploading.

Trading activity, cost basis, gains and losses — see exactly what's happening in client brokerage accounts.

Year-over-year tax return comparison in Excel — quickly analyze trends and spot planning opportunities.

Trusted by leading companies